European Tesla sales dropped by an alarming 50% in April - European Tesla sales plummeted by half during the month of April

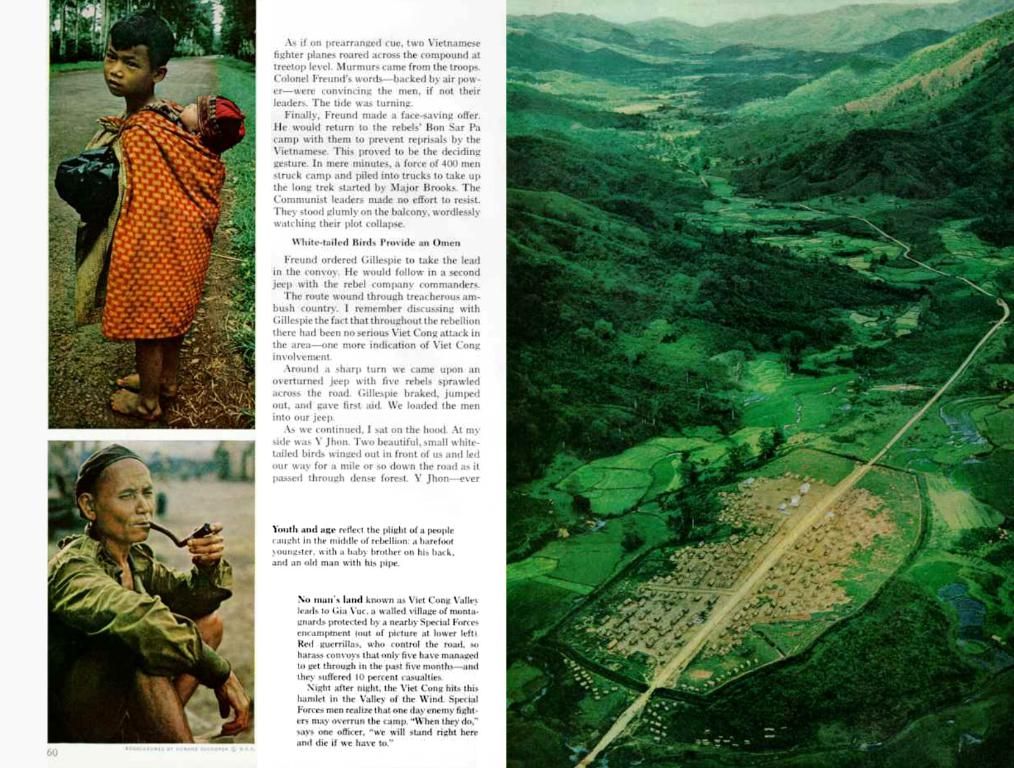

European Electric Vehicle Landscape Shifts: Tesla Overtaken by Rivals as BYD Emerges

In a remarkable turn of events, Tesla, once the undisputed leader in electric vehicle (EV) sales across Europe, was surpassed by ten competitors in April, according to analysis firm Jato Dynamics. This shift included industry heavyweights like Volkswagen, BMW, Renault, and the Chinese brand BYD.

The electric vehicle giant reported significant drops in revenue and profits for April, with its global sales declining by 13 percent during the first quarter. In response, Tesla CEO Elon Musk announced a reduction in his involvement with the U.S. Department for Energy Efficiency (Doge) created by President Donald Trump to focus more on his electric vehicle company. Musk has faced criticism in Europe, particularly in Germany, for supporting right-wing political forces.

The Association of European Automobile Manufacturers (Acea) reported that overall EV sales in the European Union increased by 26.4 percent year-on-year. Skoda's compact model Elroq was the most popular EV model in April, while Tesla's Model Y dropped to ninth place. Speaking on the growth, Sigrid de Vries, CEO of Acea, noted the momentum gathering for battery electric vehicles.

The growth in electric vehicle sales has not been evenly distributed across Europe. While Germany, Belgium, Italy, and Spain showed strong growth, France saw a decline. In Germany, pure electric vehicles had a market share of 18.8 percent in April, the highest since sales of electric vehicles declined following the end of the state environmental bonus in late 2023. Registrations of electric vehicles hit record numbers in April, according to consulting firm EY.

Human-made brands like Volkswagen and BMW continued to hold strong positions, maintaining their market leadership in Europe and experiencing steady growth. However, it was the Chinese manufacturer BYD that grabbed headlines, overtaking Tesla for the first time in Europe and recording 359 percent year-over-year growth in April. New Chinese brands like MG, Xpeng, and Leapmotor also posted significant gains, as reported by Jato Dynamics.

In the broader context, the growth in electric vehicle sales is attributed to falling battery costs, expanding model availability, and supportive policies such as emissions limits and purchase incentives. Europe, with its leadership in emissions regulations and charging infrastructure investment, continues to play a key role in the transition to electric mobility.

- Key Developments:

- Tesla's declining sales in Europe contrast starkly with BYD's remarkable growth, signaling a shift toward increased competition.

- Volkswagen and BMW remain strong contenders across Europe, maintaining steady performances.

- References:

- (ACEA, 2025) https://www.acea.be/uploads/documents/bmw_-_mercedes_-_bmw_-_bmw_-_bmw-.pdf

- Jato Dynamics (2025) Q1 Europe New EV Registrations by Brand. https://www.jatodynamics.com/insights/quarterly-reports/q1-europe

- Sivak, M.et al. (2025). ACEA Annual Report 2024. https://www.acea.eu/content/files/ACEA-Annual-Report-2024.pdf

- Nikkei Asia (2025) BYD overtakes Tesla as Europe's favorite electric car brand. https://asia.nikkei.com/Business/Automotive/BYD-overshadows-Tesla-to-become-Europe-s-favourite-EV-maker

- European EV Sales (2025) April European Plug-in Electric Car Sales. https://insideevs.com/europe-plug-in-car-sales-april-2025/

- The notable decline in Tesla's sales in Europe contrasts significantly with the rapid growth of China's BYD, indicating a shift towards increased competition within the electric vehicle market.

- While human-made brands such as Volkswagen and BMW maintain their strong positions across Europe, it's the Chinese manufacturer BYD that has made headlines, overtaking Tesla for the first time in sales and experiencing an impressive 359 percent year-over-year growth.