GST Revision: Reduced prices on compact vehicles and minimal motorbikes starting from the Navaratri festival

The Indian automotive sector is set to experience a significant boost, as the government has announced a revised Goods and Services Tax (GST) system that could potentially return the industry growth rate to around 7% per year.

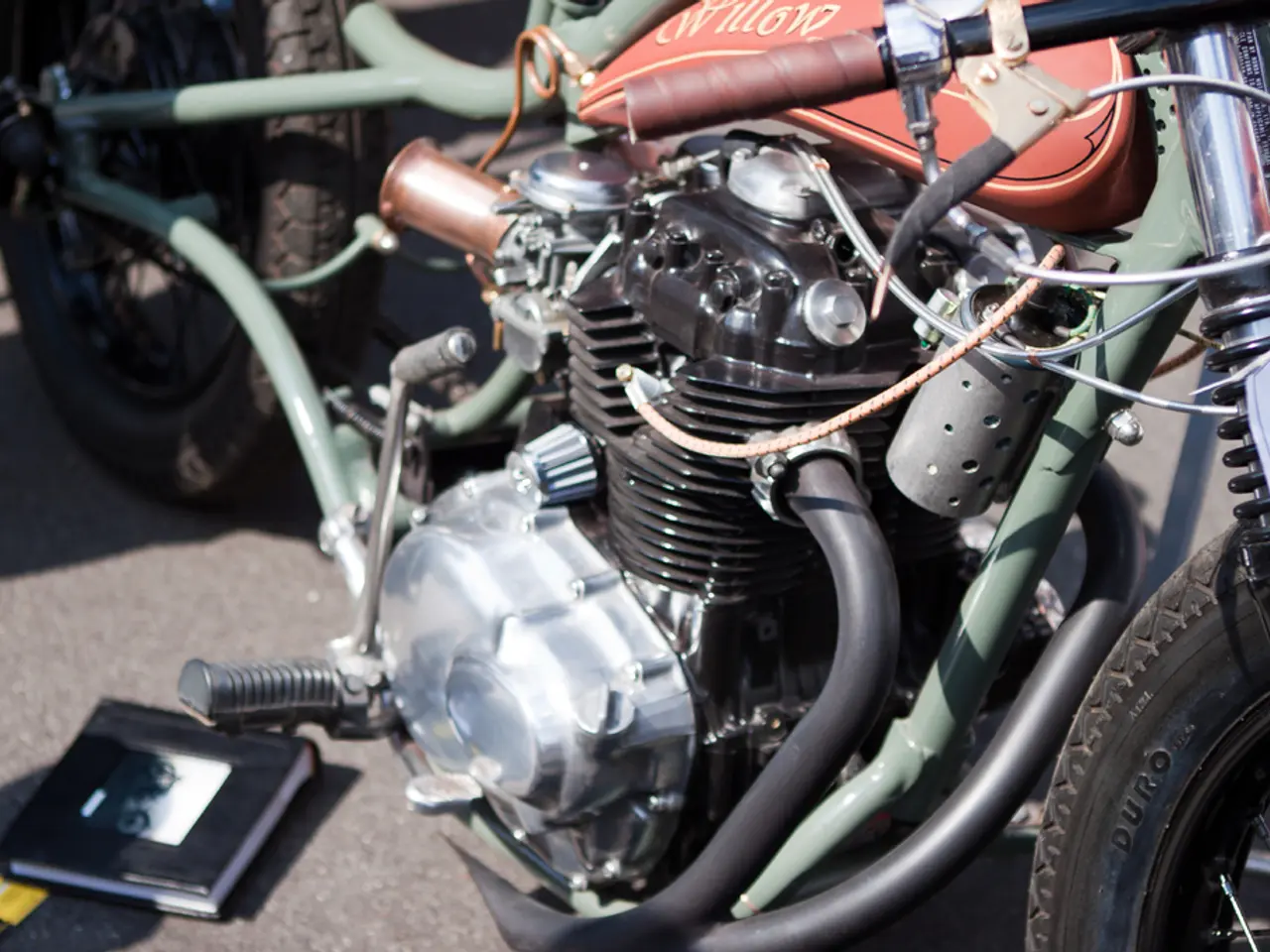

One of the key changes is the reduction of the GST rate for small cars (under 1,200cc/4,000 mm) and entry-level motorcycles (up to 350cc) from 28% to 18%. This reduction is expected to benefit small car manufacturers and motorcycle makers, including giants like BMW Motorrad, KTM, and smaller electric vehicle companies, as well as domestic players such as Maruti Suzuki, Hero MotoCorp, Honda Motorcycle & Scooter India, Bajaj Auto, and TVS Motor.

RC Bhargava, Chairman of Maruti Suzuki India, has stated that the reduced GST will stimulate the market and make safer and more comfortable mobility more accessible to more people. The Society of Indian Automobile Manufacturers (SIAM) is confident that this move will bring renewed cheer to consumers during the festive period and inject fresh momentum into the Indian automotive sector.

The 40% GST on premium cars without any additional cess is considered good news for the premium car industry, with Hardeep Singh Brar, President and CEO of BMW Group India, expressing optimism that this will drive new sales. On the other hand, the GST rate of 5% on electric vehicles (EVs) remains unchanged, which is seen as beneficial by Santosh Iyer, MD and CEO of Mercedes-Benz India.

Sixty percent of the Internal Combustion Engine (ICE) portfolio will now be under the 18% GST slab rate. Passenger vehicles running on petrol, LPG, and CNG, with engines under 1,200 CC and not exceeding 4,000 mm in length, will be charged at 18% GST. Diesel vehicles of up to 1,500 CC and 4,000 mm length will also move to the 18% rate.

However, vehicles above 1,200 CC, longer than 4,000 mm, motorcycles above 350 CC, and racing cars will be charged at a 40% GST levy. Shailesh Chandra, President of SIAM, has expressed confidence in the government notifying suitable mechanisms for the utilisation of compensation cess on unsold vehicles.

The revised GST rates are expected to boost consumption and bring momentum to the automotive industry. Analysts predict that models like Maruti Alto, WagonR, and Swift, as well as Hyundai Grand i10 and i20, will see around a 12% reduction in cost due to the revised GST rates.

Industry veterans like Santosh Iyer believe this GST revision will induce the much-needed impetus and ensure a faster transition to a decarbonised future. The GST overhaul directly benefits the automotive sector, with the revision expected to stimulate the market and make a positive impact on the industry's growth trajectory.