The Expansion of Digital Banking: A Look at its $15.4 Trillion Predicted Growth by 2034

In the rapidly evolving world of finance, digital banking is making significant strides, poised to exceed USD 15.4 trillion by 2034. This transformation is driven by a host of key strategies, including building modularly, prioritizing time-to-value, monetizing through ecosystems, and operationalizing AI responsibly, while measuring what matters.

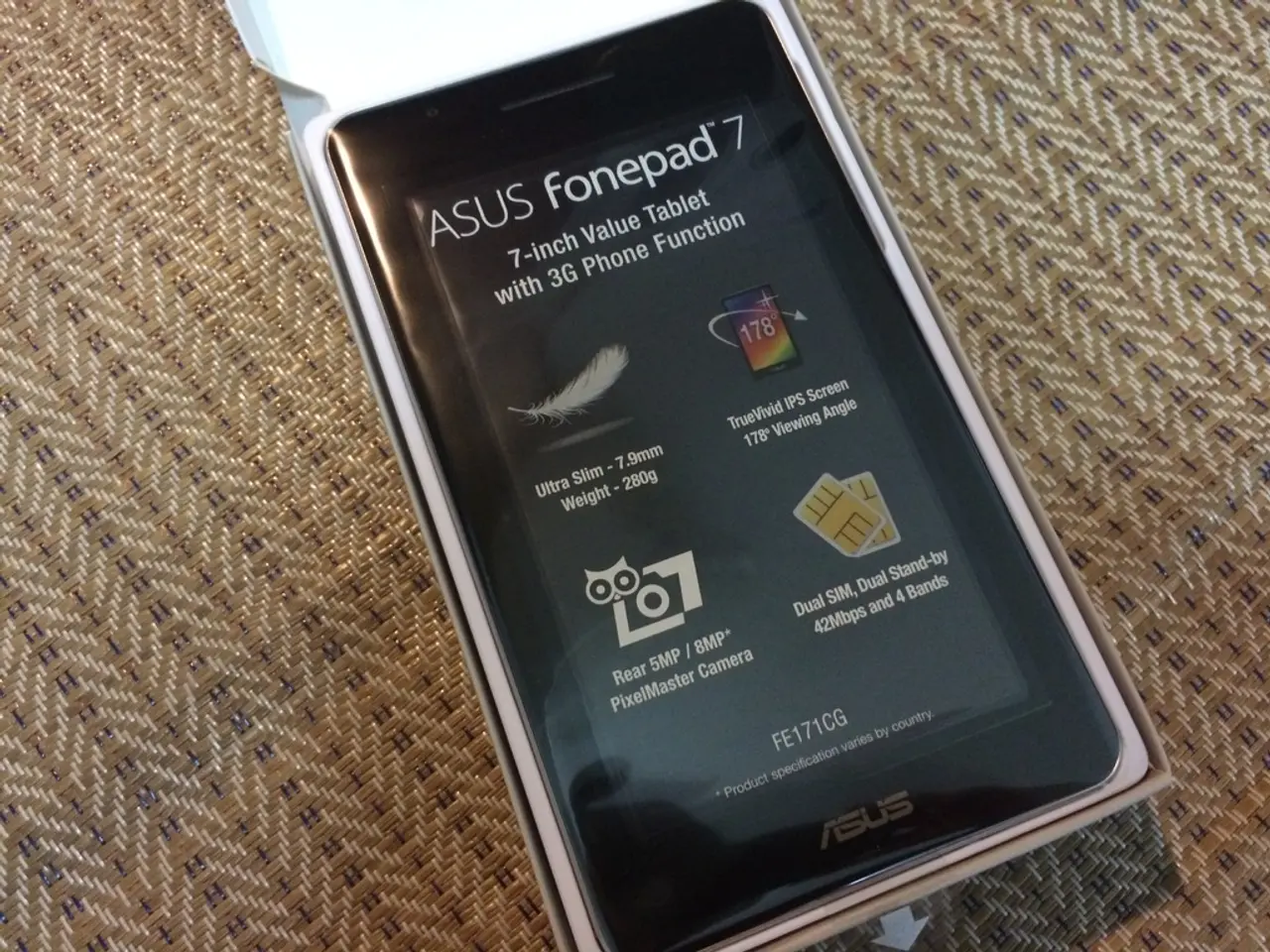

One of the primary advantages of digital banking is its ability to deliver transactions at a fraction of the cost of traditional, branch-based models. Fully digital operating models are increasingly becoming the norm, thanks to ubiquitous connectivity and smartphones. This cost-to-serve advantage is compounding the expansion of digital banking.

Cybersecurity and fraud are growing concerns in the digital banking landscape. To address these issues, banks are implementing robust security measures such as device fingerprinting, behavioral biometrics, zero-trust architectures, and continuous authentication.

Europe benefits from strong open banking mandates and data portability, which are making banks platforms, not products. Open banking and APIs are inviting third parties to build new experiences on top of secure rails. This trend is particularly evident in the Banking-as-a-Service (BaaS) sector, where leading market players include Stripe, Mastercard, Fiserv, Rapyd Financial Network, and Unicorn Payment. North America holds the largest market share, but BaaS growth is also being driven by API-first platforms enabling integration of banking services into digital applications, including in crypto banking, embedded finance, and industries like travel and healthcare.

Asia-Pacific is leading in mobile-first adoption, super-app ecosystems, and QR-based payments. In recent years, there has been a surge in BaaS and real-time payments infrastructure in North America. For many consumers, especially in emerging markets, their first "bank branch" is a mobile app.

In the coming years, trends to watch include the shift from financial products to financial journeys, the rise of context-aware banking, invisible payments and autonomous finance, B2B digitization catching up, and the growth of green finance and impact analytics.

However, this digital transformation also presents challenges. Regulatory complexity demands proactive engagement, robust compliance tooling, and explainable AI, especially for cross-border services. Data privacy is essential, with transparent consent and granular controls being table stakes.

In conclusion, the digital banking landscape is dynamic and promising. With advances in cloud computing, AI-enhanced services, blockchain integration, and smart contracts, digital banking is becoming more seamless, programmable, and automated, enabling more efficient and personalized financial transactions.